unrealized capital gains tax california

Even a tax on realized capital gains impedes innovation. High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408.

The Trouble With Unrealized Capital Gains Taxes The Spectator World

Bidens proposed wealth tax styled as a minimum income tax on households worth more than 100 million will claim at least 20 of both income and unrealized capital gains.

. Tails the loss is 100 million. Bidens fiscal 2023 budget request released Monday would impose a 20 minimum tax on the unrealized capital gains for households worth at least 100 millionYou cant be taxed on things. If the estate sells assets with unrealized gains those gains will be subject to capital gains tax.

If that phrase. 2 days agoEven among tax attorneys there is disagreement over whether unrealized capital gains should be considered wealth or income Kaplan said. An income tax is the obvious example and indeed income taxes were held unconstitutional until we ratified the 16th Amendment.

If mark-to-market taxation of capital gains is a direct tax is not covered by the 16 th Amendment and is not apportioned then it is unconstitutional. Capital gains tax could be applied to the value of securities portfolios owned by the ultra wealthy. Jack Salmon argues that taxing unrealized capital gains simply makes no sense.

Americans Oppose Taxing Unrealized Gains. Texas long term capital gain rate 0. Im seeing other internet articles that state that unrealized gains within the HSA are NOT taxed in CA only actual gains like dividends that are paid out capital gains if a mutual fund is sold etc.

National Investment Income Tax 38. Visit Instructions for California. Bidens 58 trillion budget proposal includes a tax on unrealized gains meaning some Americans would have to pay for the appreciation of assets.

Taxing unrealized Capital gains on the value of securities is rich. A Texas resident would see the following taxes. Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent.

If you have a difference in the treatment of federal and state capital gains file California Capital Gain or Loss Schedule D 540. November 29 2021 by Brian A. Americans oppose taxing unrealized gains by a ratio of 3-1 according to a survey experiment with 5000 respondents published in May 2021.

Heads an investor keeps 45 million. Total long term capital. Suppose we raise capital gains taxes to match income tax rates as is perennially proposed by the left.

If we ignore tax-exempt investors and if Bidens proposal to tax unrealized capital gains at 20 had already been law 25 years ago these fortunate Amazon investors or. A direct tax is a tax on property which includes money or the income derived from property which cannot be shifted onto someone else. Unrealized Capital Gains Tax.

Federal long term capital gain rate 396 BidenYellen proposal v 20 today. Bidens proposed wealth tax styled as a minimum income tax on households worth more than 100 million will claim least 20 of. Likewise a tax on unrealized capital gains would be a direct tax.

Unrealized Capital Gains Tax. This tax is just the latest attempt by the Democrats to reshape the tax code and pass a tax on unrealized gains. Critics rally against Bidens capital gains tax proposal.

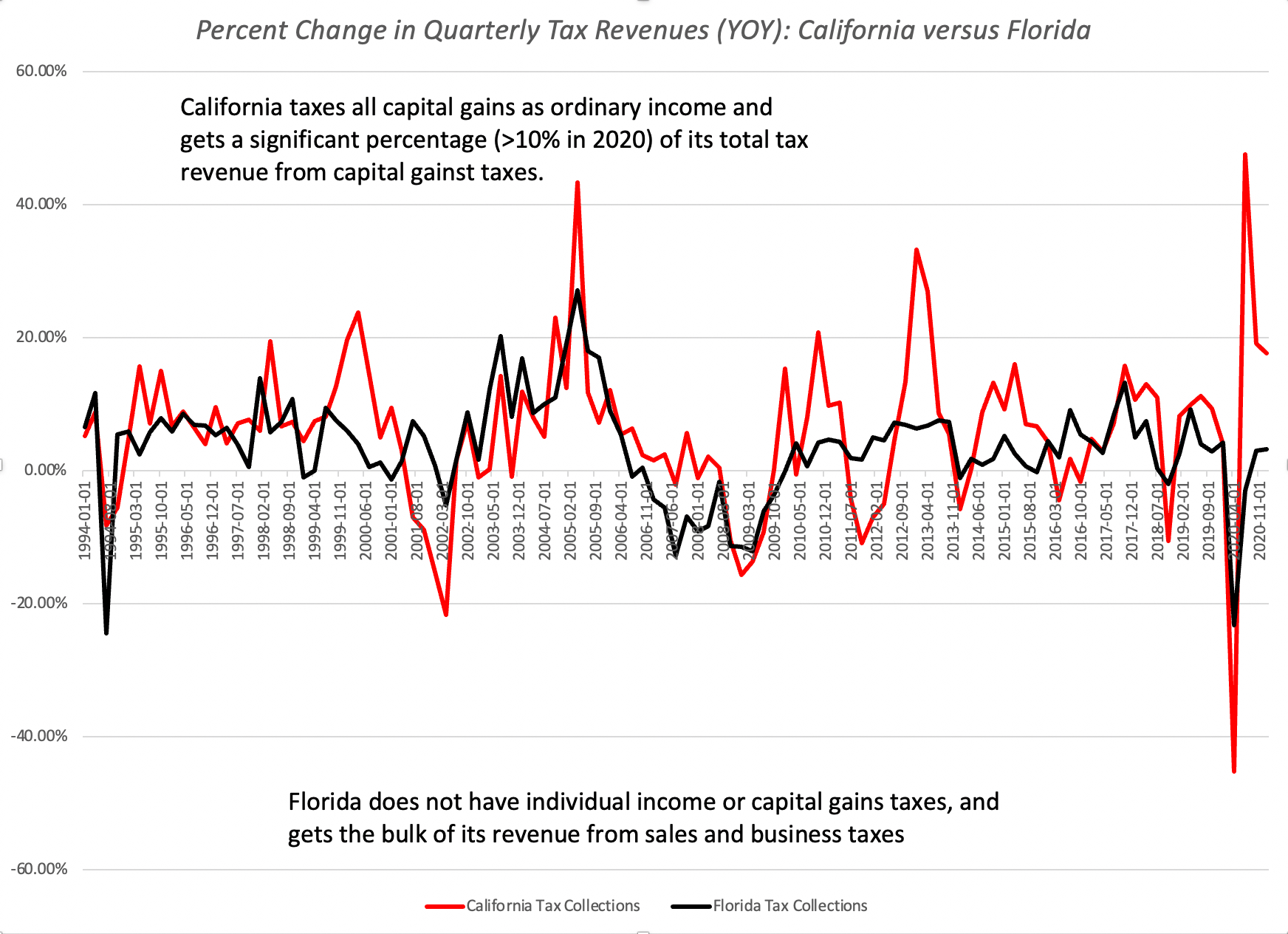

California long term capital gain rate 133. Earlier this week the president proposed a minimum 20 percent tax rate that would hit both the income and unrealized. Total long term capital gain rate 567.

I believe that the final tax return of the. Individual Income Tax Return IRS Form 1040 and Capital Gains and Losses Schedule D IRS Form 1040. National Investment Income Tax 38.

To report your capital gains and losses use US. If an asset is projected to make money but you dont cash in on that profit its an unrealized gain. Actually good point.

Unrealized Capital Gains Tax Capital Gains Tax Rate 2022 It is widely believed that capital gains are the result of earnings made through the sale an asset such as stocks real estate stock or a company and that these profits constitute taxable income. This new tax is similar to the wealth taxes pushed by radical. This tax called a billionaire minimum income tax would impose an annual 20 percent tax on taxpayers with income and assets that exceeding 100 million a 360 billion tax increase.

Earlier this week the president proposed a minimum 20 percent tax rate that would hit both the income and unrealized capital gains of. Therefore Bidens proposal is a 20 percent tax on all income plus unrealized capital gains for households where that income and. The Center Square President Joe Bidens newly released 2023 budget included a tax provision that has come under extra scrutiny.

In California or New York the combination of federal state and local taxes sums to around a 55 top tax rate. Given that uncertainty Bidens tax plan probably would. Unrealized Capital Gains Tax Commit to Equity Coalition Demands CA Billionaire Tax Millionaire Tax and Additional Tax on Stock Gains August 20 2020 723 pm August 20 2020 723 pm.

Anyone else care to chime in.

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

Sen Ron Wyden S Capital Gains Tax Plan Devotes Trillions To Social Security Wsj

The Unintended Consequences Of Taxing Unrealized Capital Gains

Search Search Home About Our Experts Our Achievements Events Subscriptions What S New National Security Health Care Health Care Publications Health Care Commentaries Health Care Newsletters Kellye Wright Fellowship Health Policy Blog Taxes

Taxing Unrealized Capital Gains A Bad Idea National Review

Biden S Better Plan To Tax The Rich Wsj

Understanding The California Capital Gains Tax

Eliminate Capital Gains Tax With A Trust

The Billionaire Tax Proposal A No Good Awful Terrible Idea Youtube

Aswath Damodaran On Twitter As Increases In Tax Rates Are Taken Off The Table Taxing Billionaires On Unrealized Capital Gains Seems To Be Gaining Traction I Am Amazed By Congress S Capacity To

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Dems Latest Idea To Fund Their Spendapalooza As Desperate As It Gets

Unrealized Capital Gains Tax Stock Bitcoin Bitcoin Magazine Bitcoin News Articles Charts And Guides

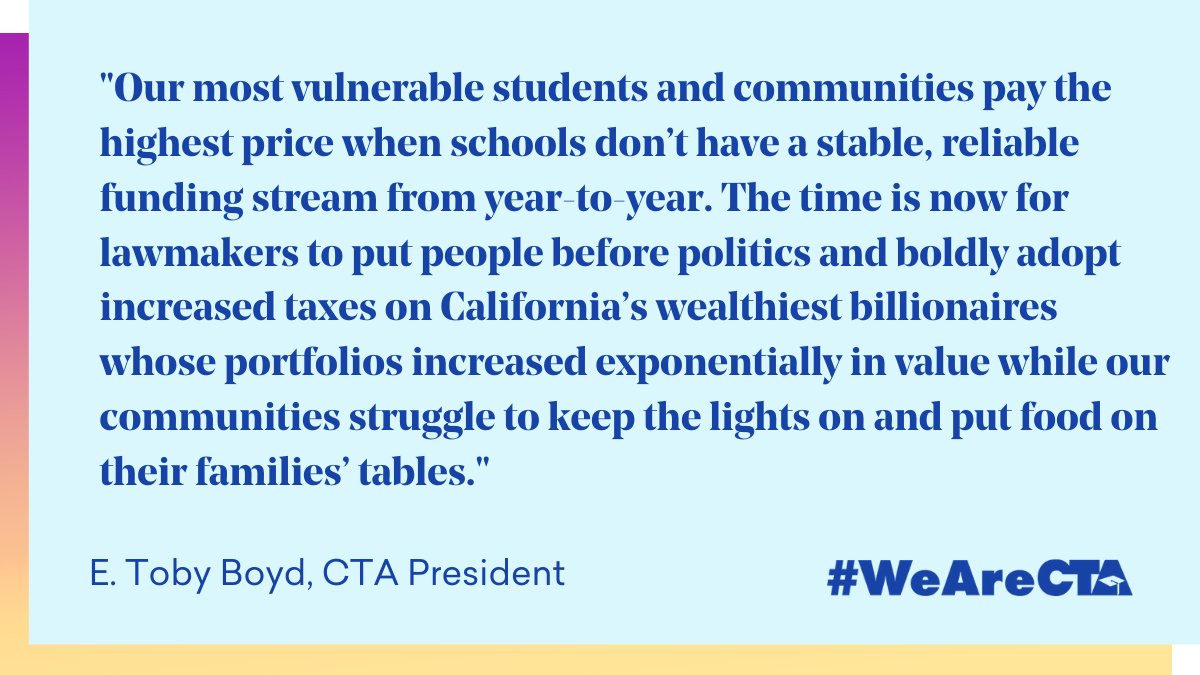

State Leaders Propose Wealth Tax On Ultra Rich California Teachers Association

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)