internet tax freedom act texas

The Internet Tax Freedom Act ITFA. PITFA represents a permanent ban on taxing internet access and an elimination of the grandfathered ability to tax internet access currently allowed in seven states.

What Is The Internet Tax Freedom Act Howstuffworks

The exemption is mandated by the Internet Tax Freedom Act ITFA which was first enacted in 1998 to encourage growth of the fledgling internet.

. The states would have collected nearly 1 billion in fiscal year 2021. These states are under the grandfathered clause allowed to tax internet access because they implemented a tax prior to. At the time no one knew what.

Senate approved a permanent extension of the Internet Tax Freedom Act that was included in HR. But the grandfather clause has permitted such taxes if they were generally imposed and actually enforced prior to October 1 1998. The Internet was still the start-up and the premise was that people wanted a way to access the Internet.

644 the Trade Facilitation and Trade. Beginning July 1 2020 Texas will no longer impose sales tax on separately stated internet access charges due to the Internet Tax Freedom Act ITFA of 2016. Groups Push for Permanent Internet Tax Freedom Act.

The Act was signed in 1998 on Internet Tax Freedom. The ten states are Hawaii New Hampshire New Mexico North Dakota Ohio South Dakota Tennessee Texas Washington Wisconsin. Hawaii New Mexico North Dakota Ohio South Dakota Texas and Wisconsin.

Multiple or discriminatory taxes on electronic commerce. Congress extended the ITFA. The Internet Tax Freedom Act ITFA.

644 the Trade Facilitation and Trade Enforcement Act of 2015. 105-277 enacted in 1998 implemented a three-year. The 1998 Internet Tax Freedom Act is a United States law authored by Representative Christopher Cox and Senator Ron Wyden and signed into law as title XI of PubL.

But the grandfather clause has permitted such taxes if they were generally imposed and actually enforced prior to October 1 1998. Since no one knew it the initial act was a 10-year ban on the taxation of Internet usage instead of a lifelong exemption. 105-277 enacted in 1998 implemented a three-year moratorium preventing state and local governments from taxing Internet access or imposing multiple or discriminatory taxes on electronic commerce.

Little-noticed changes to the Internet Tax Freedom Act made by Congress in 2007 expanding the scope of services preempted from state taxation are at issue in Apple Inc. Internet Tax Freedom Act - Title I. Federal law included a grandfather clause for those state and local governments including Texas who imposed a tax on internet services prior to October 1 1998.

A PERMANENT MORATORIUMSection 1101a of the Internet Tax Freedom Act 47 USC. Federal law included a grandfather clause for those state and local governments including Texas who imposed a tax on internet services prior to October 1 1998. 1 taxes on Internet access unless such tax was generally imposed.

Accordingly the six remaining states that tax Internet access Hawaii New Mexico Ohio South Dakota Texas and Wisconsin must by federal law stop. ITFA prohibits states and political subdivisions from imposing taxes on Internet access. Beginning July 1 2020 Texas will no longer impose sales tax on separately stated internet access charges due to the Internet Tax Freedom Act ITFA of 2016.

105277 text PDF on October 21 1998 by President Bill Clinton in an effort to promote and preserve the commercial educational and informational potential of the Internet. Hawaii New Mexico North Dakota Ohio South Dakota. Texas collected tax on internet access prior to the enactment of ITFA under the.

On February 24 2016 the President signed into law the Trade Facilitation and Trade Enforcement Act of 2015 TFTEA which permanently bans state and local jurisdictions from imposing taxes on Internet access or imposing multiple or discriminatory taxes on electronic commerce. The Internet Tax Freedom Act ITFA passed in 1998 imposed a moratorium preventing state and local governments from taxing internet access. The bill also establishes an end date of June 30 2020 for the seven states that currently impose a tax on internet access.

Permanent Internet Tax Freedom Act Amends the Internet Tax Freedom Act to make permanent the ban on state and local taxation of Internet access and on multiple or. Internet Tax Freedom Act ITFA The ITFA was enacted in 1998 as a 3-year moratorium preventing governments at the local state and federal levels from imposing transaction taxes on internet access one of the exceptions being that states already taxing internet access as of October 1 1998 were grandfathered in. The act made permanent a temporary moratorium on such taxes that.

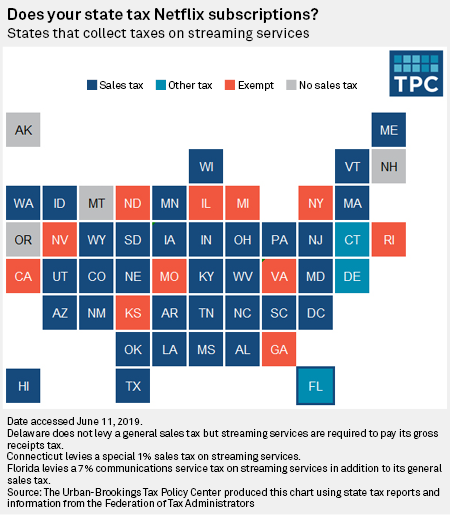

Moratorium on Certain Taxes - Prohibits a State or political subdivision thereof from imposing the following taxes on Internet transactions occurring during the period beginning on October 1 1998 and ending three years after the date of enactment of this Act. More than 40 organizations have written to Senate majority leader Mitch McConnell and minority leader Harry Reid asking the Senate to pass the Internet Tax Freedom Act ITFA which would make permanent a long-standing ban in all but a few states on taxing Internet access service. On July 1 sales taxes levied on internet access in six statesHawaii New Mexico Ohio South Dakota Texas and Wisconsinwill become illegal under the provisions of the Permanent Internet Tax Freedom Act PITFA.

At the time people mostly used it for email. On February 11 2016 the US. On July 1 sales taxes levied on internet access in six statesHawaii New Mexico Ohio South Dakota Texas and Wisconsinwill become illegal under the provisions of the.

Moratorium preventing state and local governments from taxing Internet access or imposing. Internet access fees are currently subject to state and local sales tax in Hawaii New Mexico Ohio South Dakota Texas and Wisconsin. On June 30th 2020 the Internet Tax Freedom Acts grandfather clause will expire.

Hegar a test case pending in Texas. As of July 1 2020 those fees will be exempt. Beginning July 1 2020 Texas will no longer impose sales tax on separately stated internet access charges due to the Internet Tax Freedom Act ITFA of 2016.

On June 30 2020 the grandfathering provisions of the Internet Tax Freedom Act ITFA 1 which permitted states that taxed internet access before the ITFAs enactment to continue doing so will expire. Under the grandfather clause included in the Internet Tax Freedom Act Texas is currently collecting a tax on Internet access charges over 2500 per month. On June 30th 2020 the Internet Tax Freedom Acts grandfather clause will expire.

ITFA prohibits states and political subdivisions from imposing taxes on Internet access. In particular Ohio and Texas have imposed their sales taxes on. On July 1 2020 the Permanent Internet Tax.

151 note is amended by striking during the period beginning November 1 2003 and ending October 1 2015.

Texas Blockchain Legislation Status Blockchain And Cryptocurrency Regulations

What Is The Internet Tax Freedom Act Howstuffworks

I Am Visiting From Another Country Can I Get A Refund Of Sales Taxes Paid Sales Tax Institute

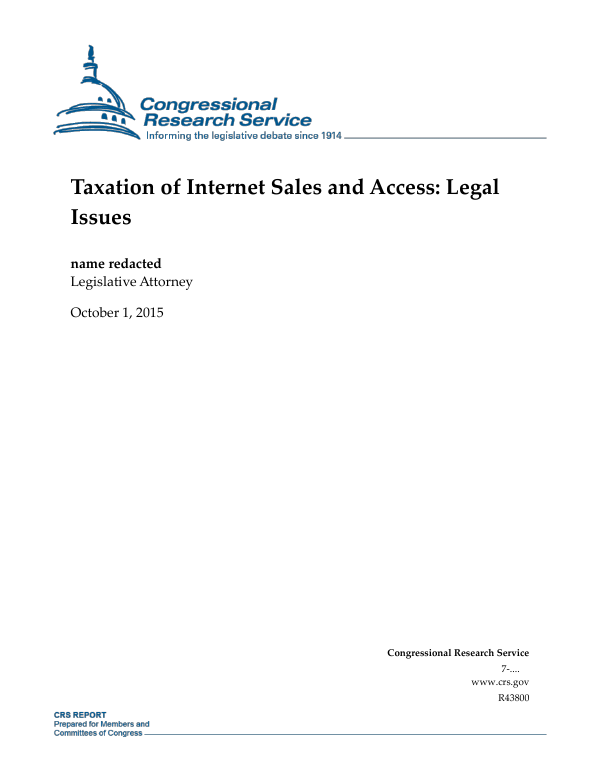

Taxation Of Internet Sales And Access Legal Issues Everycrsreport Com

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

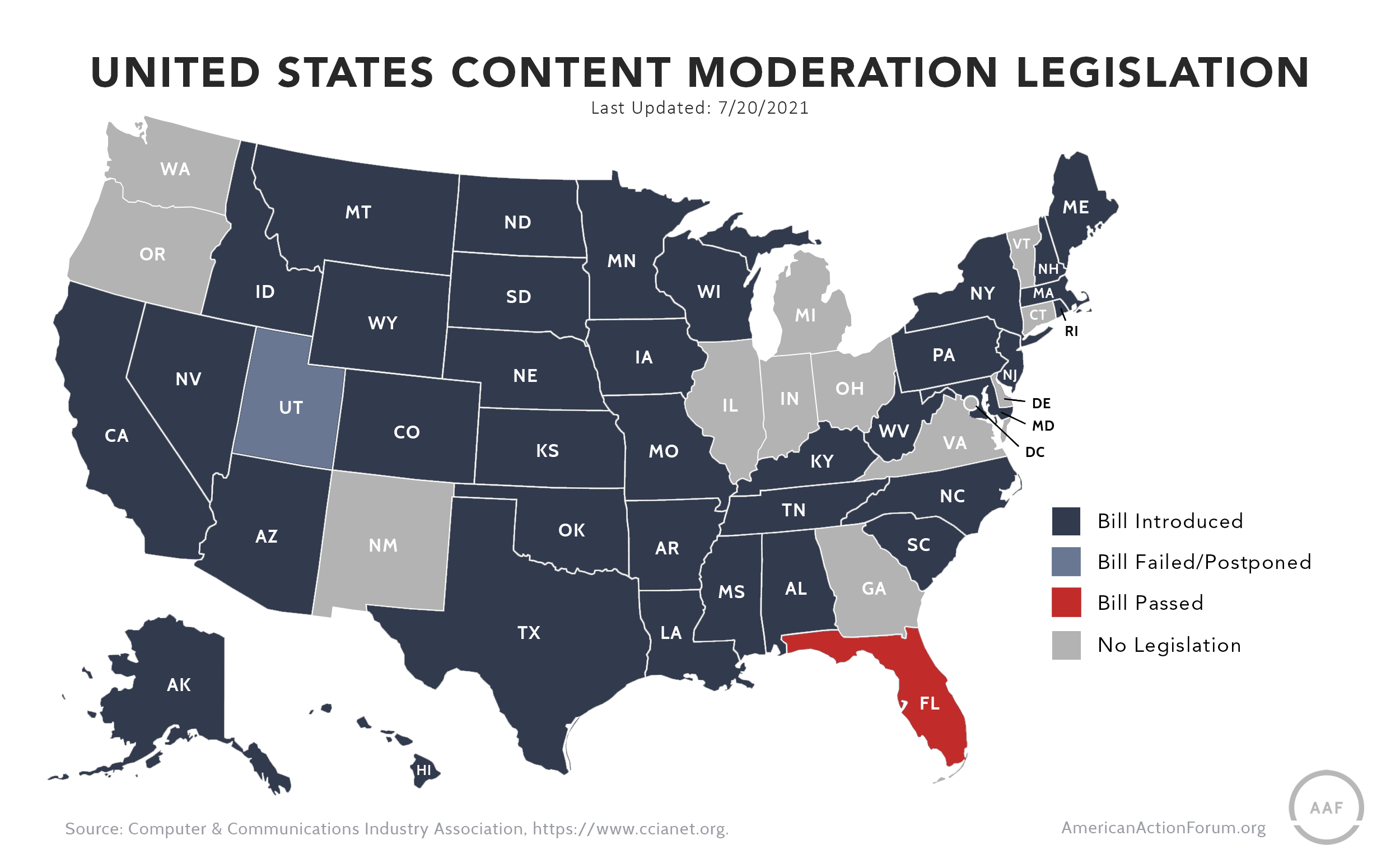

Examining State Tech Policy Actions In 2021 Aaf

More Us States Introduce Streaming Tax S P Global Market Intelligence

Controversial Internet Tax Freedom Act Becomes Permanent July 1

Tac County Management Risk Conference

Texas Lawmaker Introduces Digital Ad Tax Bill How Does It Stack Up To Maryland S Salt Savvy

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

What Is The Internet Tax Freedom Act Howstuffworks

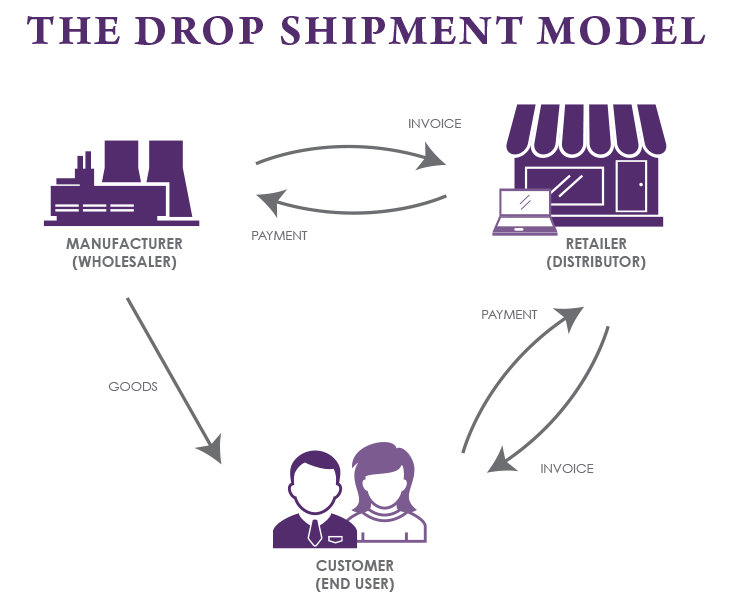

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute