city of chattanooga property tax increase

Chattanooga property tax increase for 2010-11 13 million. Additionally all feespenalties may NOT appear online.

New Chattanooga City Budget Includes Property Tax Increase For Some River City Homes

To reach our Technical Assistance Center please call.

. Payments by Credit Card or Debit Card will incur the following charges whether you pay in person online or over the phone. Thats right -- some folks got really serious tax cuts although half the people in Hamilton County and the city of Chattanooga got property. Soddy-Daisy residents will see their property tax rate increased by 32 cents and could likely see another 5- or 10-cent raise next year.

Property Tax Relief The State of Tennessee provides Tax Relief for the elderly age 65 and over and the disabled. To view the criteria that must be met in order to qualify please click here. For inquiries regarding sewer fees.

The City of Chattanooga Tax Freeze Program was implemented to help senior citizens by freezing the property tax amount on their primary residence including Mobile homes for future years. Applicants must reapply every year to participate in the subsequent year. Ad Find Out the Market Value of Any Property and Past Sale Prices.

The property taxes levied on taxable property in the City are billed on October 1st of each year and are due without interest and penalty by the last day of February of the following year. The City Council on Tuesday night unanimously approved a 40-cent property tax increase above the new certified rate. Applications must be submitted and approved annually.

- Downtown Form-Based Code. Credit or Debit card - 235 or 149 minimum. The tax rate under the Kelly budget would be 225 - 40.

Ten years of tax information is available online. The new certified tax rate for Chattanooga is 18529 per 100 of assessed value. City Of Chattanooga - Code Of Ordinance Chapter 38 - Zoning Article Xvi.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. The increase raises some 30 million in new income. And international communities in an effort to increase global cooperation at the municipal level to promote cultural understanding and to stimulate economic development.

Chattanooga home- and property-owners could see an increase in their property tax bills leading into 2022 as part of a new city budget that aims to bump pay for first responders and essential workers afford infrastructure investments and pave the way for equitable growth. Box 191 Chattanooga TN 37401-0191. Information Technologies provides enterprise wide business and technology solutions for the City of Chattanooga local government.

If the tax bill is not paid by the delinquent date interest of 1 and a penalty of ½ of 1 18 per annum will be added on the first day of March and each month thereafter until the tax bill is paid. City Treasurers Office 101 East 11th Street Suite 100 Chattanooga TN 37402 423 643-7262. The fee is based on the impervious surface within a parcel.

423-643-7262 or email ptaxchattanoogagov. Paying Property Taxes by Mail. One is the Euclidean zoning that is found in the majority of the city limits.

The new certified tax rate for Chattanooga is 18529 per 100 of assessed value. PROPERTY TAX CREDIT OR DEBIT CARD PAYMENT LINK. It includes a property tax rate of 225 per 100 in a homes assessed value which the city estimates will provide a 30 million increase in revenue.

Property Tax Freeze Contact the Sumner County Trustee for a list of required documentation and qualifications at 615-452-1260. For the first time in a decade the city of East Ridge is raising property taxes. For inquiries regarding property taxes.

Council members voted 3-2 Thursday night to set the citys tax rate at 125 per 100 of a homes assessed value. Water Quality Fees Credits Incentives. You may contact our office to verify the current amount by e-mail at ptaxchattanoogagov or call 423-643-7262.

Property tax payments that include the original tax bill with the barcode and payment for the total amount due can be mailed from October through the last day in February to the following address. He said on a 100000 house a 125 percent increase would mean an annual tax increase of 6428 an increase of 112 for property worth 175000 and 128 more property tax for a house valued at. The city of Chattanooga will rely on a proposed 30 million increase in property tax revenue for the budget year that started last month.

Estimated cuts to Hamilton County 2011-12 budget 56. The other zoning type is the Form-Based Code FBC downtown code zoning. Chattanooga City Hall 101 E 11th St Room 100 Chattanooga TN 37402-4285-----Paying Property Taxes by Credit or Debit Card.

The tax rate under the Kelly budget will be 225 - 40. Tuesday September 7 2021. Sister Cities International SCI is a nonprofit citizen diplomacy network creating and strengthening partnerships between US.

The water quaity fee is the City of Chattanoogas stormwater utility. There are two types of zoning found in the city of Chattanooga.

Bowling Green Kentucky Homes Under 250k New Mexico Homes South Carolina Homes Carlsbad

Downtown Baton Rouge Louisiana Jak D Photography Louisiana Travel Family Vacation Travel Louisiana Photography

New Day New Way Bereft Of Power To Take At Will Tennessee Cities Will Have To Sell Themselves To Grow Chattanooga Times Free Press

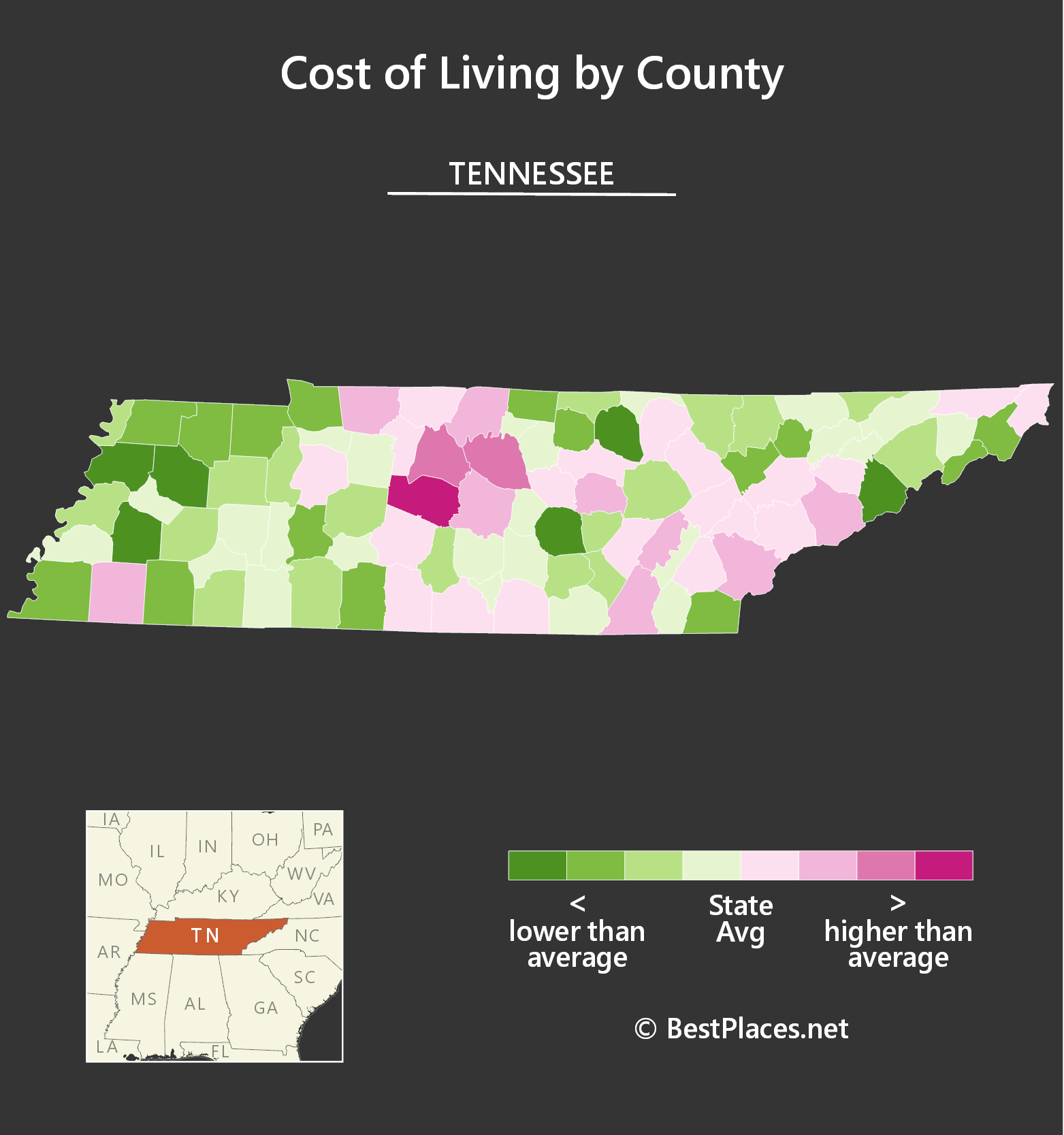

Best Places To Live In Chattanooga Tennessee

City Of Chattanooga Chattanooga Gov Twitter

Job Openings City Of Chattanooga

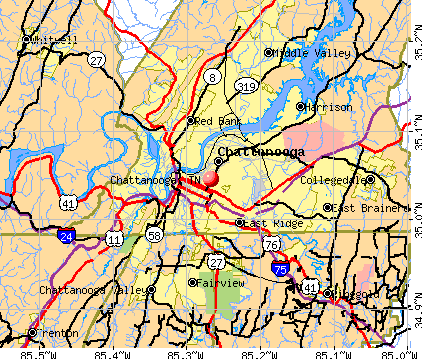

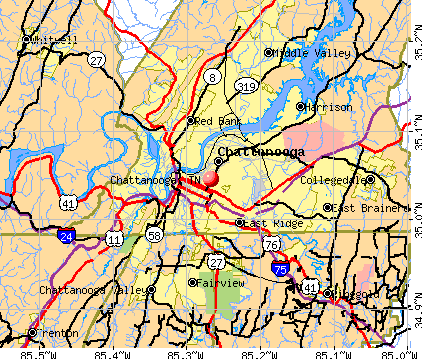

Chattanooga Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Chattanooga Crime Rate Is Chattanooga Safe Data Stats Reports Map

Study Chattanooga Ranks Below Average In Freedom Among Tennessee S Biggest Cities Chattanooga Times Free Press

City Of Clarksville Releases Quick Facts About Transportation 2020 Clarksville Online Facts City Clarksville

Chattanooga Mayor Tim Kelly Seeks To Increase City Pay With 30 Million Tax Revenue Hike Chattanooga Times Free Press

Chattanooga Suburbs Guide 2022 Best Places To Live In Chattanooga

Chattanooga Mayor Tim Kelly Seeks To Increase City Pay With 30 Million Tax Revenue Hike Chattanooga Times Free Press

Top Moving To Chattanooga Tips 2020 What S Living In Chattanooga Like